Date 9/26/17 @ 8:26pm

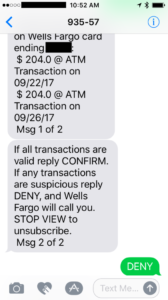

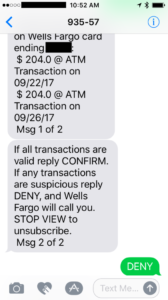

The first indication something had gone wrong in my finances came via text message stating: “Please verify activity on Wells Fargo card ending in XXXX: $204.0 @ATM Transaction on 09/22/17 $204.0 @ATM Transaction on 09/26/17 If all transactions are valid reply CONFIRM. If any transactions are suspicious reply DENY, and Wells Fargo will call you. STOP VIEW to unsubscribe”

Date 9/26/17 @ 8:45pm

I replied DENY via text message.

Date 9/26/17 @ 9pm

Next came a phone call from friendly female agent at “Wells Fargo Fraud Prevention” asking me whether I had recently made any cash advances at a “COMPASSBANK” retailer. I told her that I had not made any such purchases and that the transactions were made without my authorization. She then asked whether or not I was currently in possession of my physical credit card. I confirmed that I was, and confirmed that I had not let anyone borrow my card. She proceeded to ask me if I had recently called Wells Fargo to set a Personal Identification Number (PIN) on my Wells Fargo credit card and I informed her that I had not and in fact had never setup a PIN on that card and never used my Wells Fargo credit card to make any cash advance purchases of any kind. The agent then informed me that my card appeared to have been compromised and placed a “freeze” on the account. She informed me that this “freeze” would be blocking any further charges to the account associated with the card. She also mentioned that I would need to visit a branch office to prove my identity as soon as possible to re-activate my credit card account. She assured me that I would not be financially responsible for any unauthorized charges on the card.

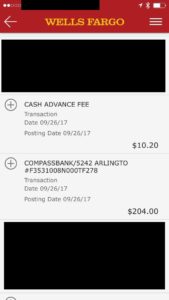

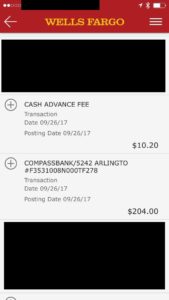

Fraudulent charges visible via online account at this point:

$204.00 COMPASSBANK/5242 ARLINGTO

$10.20 Cash Advance Fee

——————————————

$214.00 Total in Fraudulent Charges

Date 9/27/17 @ 4:00pm

I received postal letter dated 9/22/17 from Wells Fargo stating “Thank you for customizing your Personal Identification Number (PIN) on your credit ending in XXXX. The customized PIN only works with this card and will not work with any other card linked to this account.”

“If you did not customize your PIN, please contact us immediately by calling the phone number on the back of your card.”

Upon receipt of this letter, I immediately added security freezes with all three credit reporting bureaus. I also created a report at http://identitytheft.gov and filed a police report with the local police department. I visited Wells Fargo via the branch office the next day and brought the letter with me.

Date 9/28/17 @ 1pm

I visited a Wells Fargo branch office and spoke to a bank manager. Upon presenting copies of the PIN notification letter, drivers license and text notification, the bank manager proceeded to call the Wells Fargo Fraud Prevention Department. He handed me the the phone and I spoke to another one of their agents (male). I explained the letter, text and conversation with the previous agent on the evening of 9/26/17. The agent concurred that my account had likely been compromised. The agent then asked me again specifically about one of the transactions from COMPASSBANK for $204.00 and asked me to confirm that I had not authorized this charge. After confirming this, he informed me that the charge would be credited to my account soon and that since my card had been compromised it needed to be cancelled entirely. The agent asked me to destroy my credit card and mentioned that I would receive a replacement within 7 business days. At this point I also mentioned to him that there was an additional posted charge on the account for $10.20 with a description of cash advance fee. I told him that I did not recognize this charge either and the agent said that it too would be credited to my account. The agent concluded the call by thanking me for being a valued customer and to rest assured that I would not be responsible for fraudulent charges.

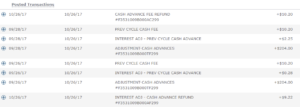

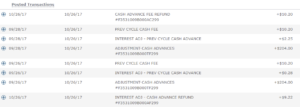

The image below is a screenshot of the two transactions I was able to see on my account via the mobile app at the time.

Date 10/3/17 @ 8:31am

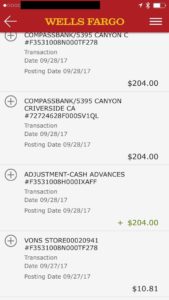

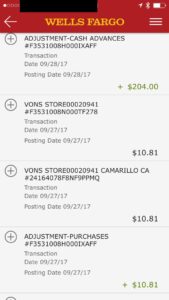

I noticed additional similar charges on my Wells Fargo credit card via mobile app account activity. Concerned about these charges having appeared after my account was supposedly “frozen”, I contacted the Wells Fargo Fraud Prevention department again. I carefully explained my situation and the history of what had transpired since 9/26/17 to the agent (female). I then told her that I noticed some additional charges from similar COMPASSBANK retailers on 9/28/17, the same day my account had been been supposedly frozen. After asking me all the same questions the agent on the 28th had asked and confirming the same answers, she proceeded to inform me that those charges could have been made before the 28th and just posted later. She assured me that I would not be responsible for fraudulent charges we proceeded to go through all additional fraudulent charges identifying each one by transaction number. During this conversation I noted that some adjustments that had been credited to my account, but that they did not appear to match the fraudulent charges in the amount or total. I made the agent aware of a credited item for a Vons grocery store purchase of $10.81 which appeared to have been adjusted/credited erroneously. I recalled the conversation at the bank branch office and told her that the agent during that call may have confused the $10.20 charge with the $10.81 charge and credited the wrong one. She told me not to worry, that she understood “what happened,” and that she would submit the additional claims and fix the erroneous credits. I mentioned that the billing date for my credit card was coming up and that I did not want to incur any interest charges on my credit card as I always pay my balance in full. She suggested that I pay the full amount minus all fraudulent charges. She tallied up the total and asked me to specifically make a payment for an amount less than the full balance on the card which she claimed was the only amount I was responsible for. I made the online payment while on the phone with her. She again assured me everything else would be taken care of and that I was not liable for fraudulent charges on my account.

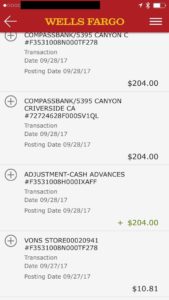

The images below are screenshots of the additional transactions that were posted to my account after it was supposedly “frozen”.

Fraudulent charges visible via online account at this point:

$204.00 COMPASSBANK/5242 ARLINGTO

$204.00 COMPASSBANK/5395 CANYON C

$204.00 COMPASSBANK/5395 CANYON C RIVERSIDE CA

($204.00) Adjustment Cash Advances

$10.20 Cash Advance Fee

$10.20 Cash Advance Fee

($10.81) Adjustment Purchases

————————————————

$417.59 Total in Fraudulent Charges

Date 10/6/17 @ 10:54am

I received a new credit card in the mail and activated it via telephone. Subsequently via my Wells Fargo online account, I noticed that my old account had been removed from view and a new account had been opened with a different account number. The new account showed a balance transfer with the full balance of my old account and the history of my old account activity. I found that none of the additional charges had been credited yet. Yet the Vons charge for $10.81 now showed as debited, credited and debited again presumably representing the correction of their mistake.

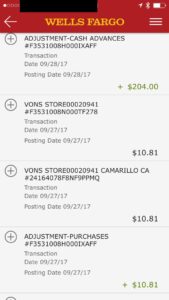

The image below shows the transactions in question.

Date 10/10/17 @ 4pm

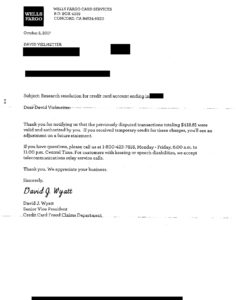

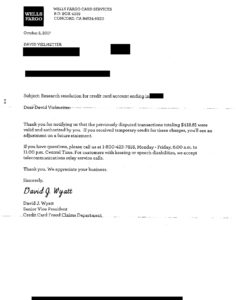

Received letter from Wells Fargo stating: “Thank you for notifying us that the previously disputed transactions totaling $418.81 were valid and authorized by you.”

At this point I was getting angry. It’d been almost a month of dealing with what felt script reader agents whose only goal appeared to be to buy time by making empty promises. The letter felt like a legal punch in the face after all the calls and documentation carefully explaining my situation. It felt like a cease and desist letter encouraging me to drop the whole thing. I certainly never “notified” anyone at Wells Fargo that the transactions were valid or authorized.

Me being the credulous person I am, the first thing I did was to try to locate the fault in me. Had I somehow confused an agent during one of my conversations? As noted in the previous call, I had mentioned that a charge from a Vons grocery store for $10.81 which had been credited was actually valid and authorized to begin with and likely confused with one of cash advance fees by one of the agents. At no point though did I make the claim that the total for valid charges was $418.81. In fact, I very meticulously went through each transaction with her referencing each fraudulent and valid charge by transaction id. This wasn’t my fault for miscommunicating. It was Wells Fargo Fraud Prevention wanting an easy way out of crediting me for the charges and by some arbitrary or unknown standard just deciding that they were going say that I had admitted to making the charges. This letter is what made me fight. I was angry and going to prove that I was the victim here and that was that.

On the same day I also received an email stating “We’re making progress on your dispute” from the Wells Fargo dispute resolution department. It was getting more and more difficult to figure out what the actual status of my dispute actually was at this point.

Date 10/10/17 @ 7:53pm

Contacted Wells Fargo Claims department about the letter and seemingly conflicting email I received (above). Spoke with a male agent and mentioned that the letter I received on 10/10/17 dated 10/5/17 was “erroneous.” I proceeded to again carefully explain my situation and the history of what had transpired since 9/26/17. I told him that now I was seeing a total of 4 fraudulent charges for $204.00 each, one adjustment for $204.00 and 4 matching cash advance fee charges. We identified each charge by transaction ID and the agent noted that some charges had already been submitted as fraud claims. He said he would submit the remaining charges and assured me that they would clear up the mishap. At this point I was relatively upset about the additional charges and the letter. He assured me that everything would be fine, that I would not be liable for charges I didn’t make and that I would see all the fraudulent charges credited to my account soon.

$204.00 COMPASSBANK/5242 ARLINGTO RIVERSIDE CA

$204.00 COMPASSBANK/5242 ARLINGTO

$204.00 COMPASSBANK/5395 CANYON C RIVERSIDE CA

$204.00 COMPASSBANK/5395 CANYON C

($204.00) Adjustment Cash Advances

$10.20 Cash Advance Fee

$10.20 Cash Advance Fee

($10.81) Adjustment Purchases

———–

$417.59

Date 10/13/17 @ 9:05am

Checked Wells Fargo credit card statement which confirmed a total of 4 COMPASSBANK fraudulent charges for $204.00 and one adjustment (credit) for $204.00.

Date 10/17/17 @ 1:21pm

Contacted Wells Fargo Claims department referencing my case details and asked for an update on my claim. The male agent put me on hold for 2 minutes and when he returned, informed me that my claim had been denied. Unf***ing believable!

When I asked why the claim had been denied the agent informed me that it had been denied because I had contacted Wells Fargo to set a PIN on my card. I told the agent that I had not set such a PIN and to please check his records because I had already told this to like 5 other agents at this point and that this had been settled back on 9/26/17. The agent informed me that once a claim had been denied, the only way to reopen the claim would be by fax supporting documentation to their dedicated fax line along with an official request. He omitted an exact definition on what an “official request” would include. He said there would be nothing further he could do for me on this claim. He proceeded to give me the Fraud Resolution/Claims department fax number 925-686-7868 and then asked me if he could assist me with anything else. I was fuming but nicely I asked about a reference number, ticket number or any other information to serve as a record of our conversation and he could not provide this information. At this point I terminated the call and was sure of one thing: I was going to divorce myself from Wells Fargo as a financial institution whatever the cost and I was going to fight this.

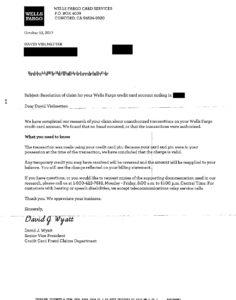

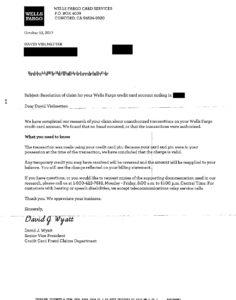

Later that evening I received the following letter confirming that my dispute had been rejected and my claim denied.

Date 10/18/17 @ 3pm

I made a branch office appointment and explained my situation there. They allowed me to fax all supporting documentation along with a letter detailing my efforts and dissatisfaction thus far to their fraud department at 925-686-7868.

Date 10/23/17 @ 10:34am

Contacted Wells Fargo Dispute Resolution department and asked for an update on my claim. I was told that my documentation (faxed on 10/18/17) had been received on 10/19/17 and that my claim was currently pending review. The agent also told me that this process of reopening a denied claim could take 30-45 business days. She mentioned that I was free to contact Wells Fargo Dispute Resolution at any time before that period to check for updates on my claim status.

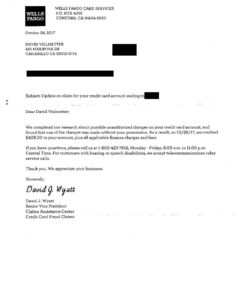

Date 10/26/17 @ 11:14am

Checked account balance on Wells Fargo credit card via online account and found $450.35 of additional credits issued by Wells Fargo on 10/26/17. The credits appeared to be matching some of the disputed charges and some I cannot explain. There appear to be two more credits for $204.00 which at this point only left a single of those charges without a credit. There also appeared to be three credits for $10.20 which brought the total to $40.80 matching all of the cash advance charges for fraudulent charges. Then there were credits for $2.25+$0.28=$2.53 which I assume is a credit for the interest charge on the disputed cash advances. Finally there was a credit for $9.22 which does not match any disputed charges I’m aware of. Whatever.

10/30/17 @ 5:17pm

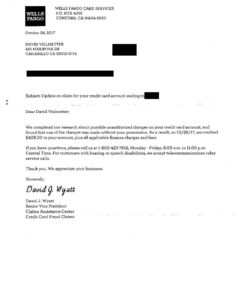

I received postal letter dated 10/23/17 from Wells Fargo stating that as I requested they were continuing to research possible unauthorized use of my credit card. It also stated that I should expect written results of this Investigation within 45 calendar days.

11/1/17 @ 5:02pm

I received postal letter dated October 26 from Wells Fargo stating that they completed researching unauthorized charges on my credit card account and found that one of the charges had been made without my permission. It said that $408.00 was credited to the account plus all applicable finance charges.

11/6/17 @ 10:31pm

Noticed that Wells Fargo posted another credit of $204.00 bringing my total after all was set and done to a credit of $9.22. I certainly wasn’t going to call back and argue with them about $9 and 22 cents. This was going to be my I’m the victim here you assholes apology fund.

Conclusion

Since publishing this post, I’ve received detailed responses from more that 100 people per year who have gone through the same ordeal with Wells Fargo. I sincerely hope this documentation and/or reading about my ordeal helps someone else. Because of my experience, I have closed all of my Wells Fargo Bank accounts and will steer clear of this firm for the rest of my life.

Thank you.